Did Federal Taxes Go Up 2025

Did Federal Taxes Go Up 2025. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules and other tax changes. The irs in november unveiled the federal income tax brackets for 2025, with earnings thresholds for each tier adjusting by about 5.4% higher for inflation.

The highest earners fall into the 37% range, while those who earn the least are in the. For a single taxpayer, the rates are:

It Helps That Nearly All The Returns Are Being Filed Electronically This Year, Which Cuts Down On Paper Delays.

The irs in november unveiled the federal income tax brackets for 2025, with earnings thresholds for each tier adjusting by about 5.4% higher for inflation.

New Year, New Tax Measures — What To Expect In 2025.

Most canadians will pay higher federal income taxes in 2025:

Explore Sources Of Us Tax Revenue By Tax Type.

Images References :

Source: www.nbcnews.com

Source: www.nbcnews.com

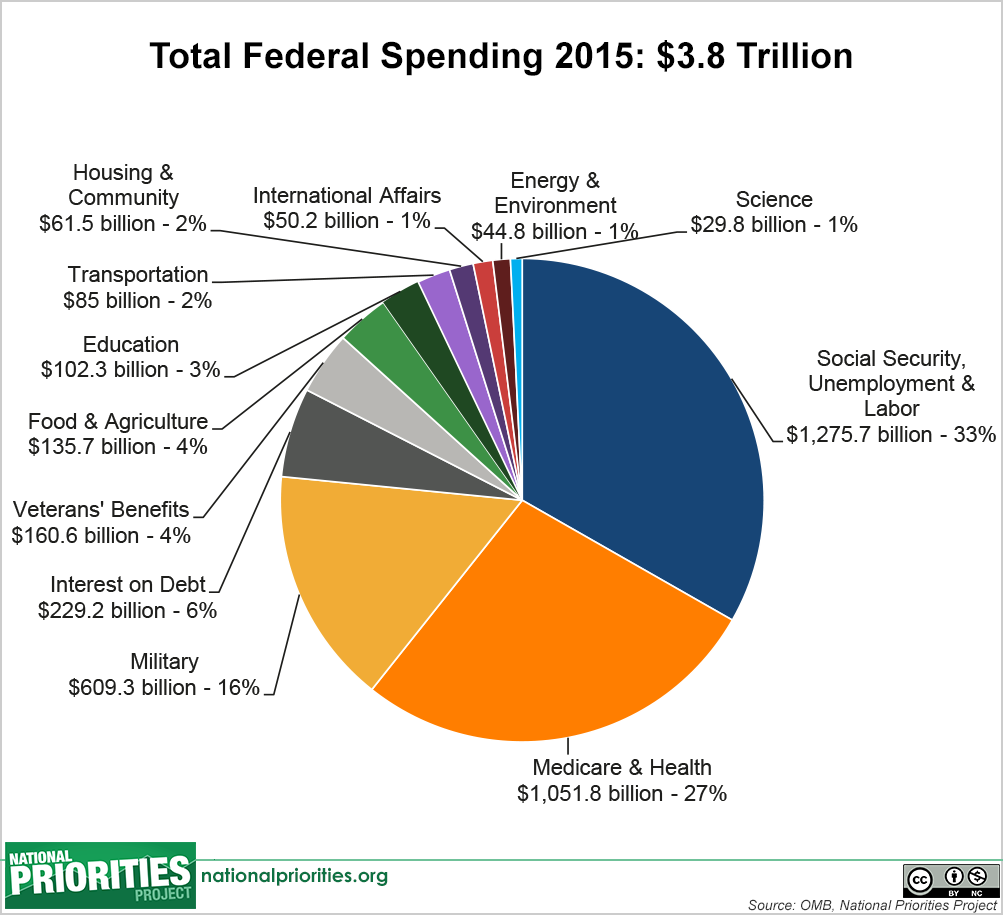

Here's where your federal tax dollars go NBC News, The agency expects more than 128. 29, 2025, as the official start date of the nation's 2025 tax season when the agency.

Source: www.slideshare.net

Source: www.slideshare.net

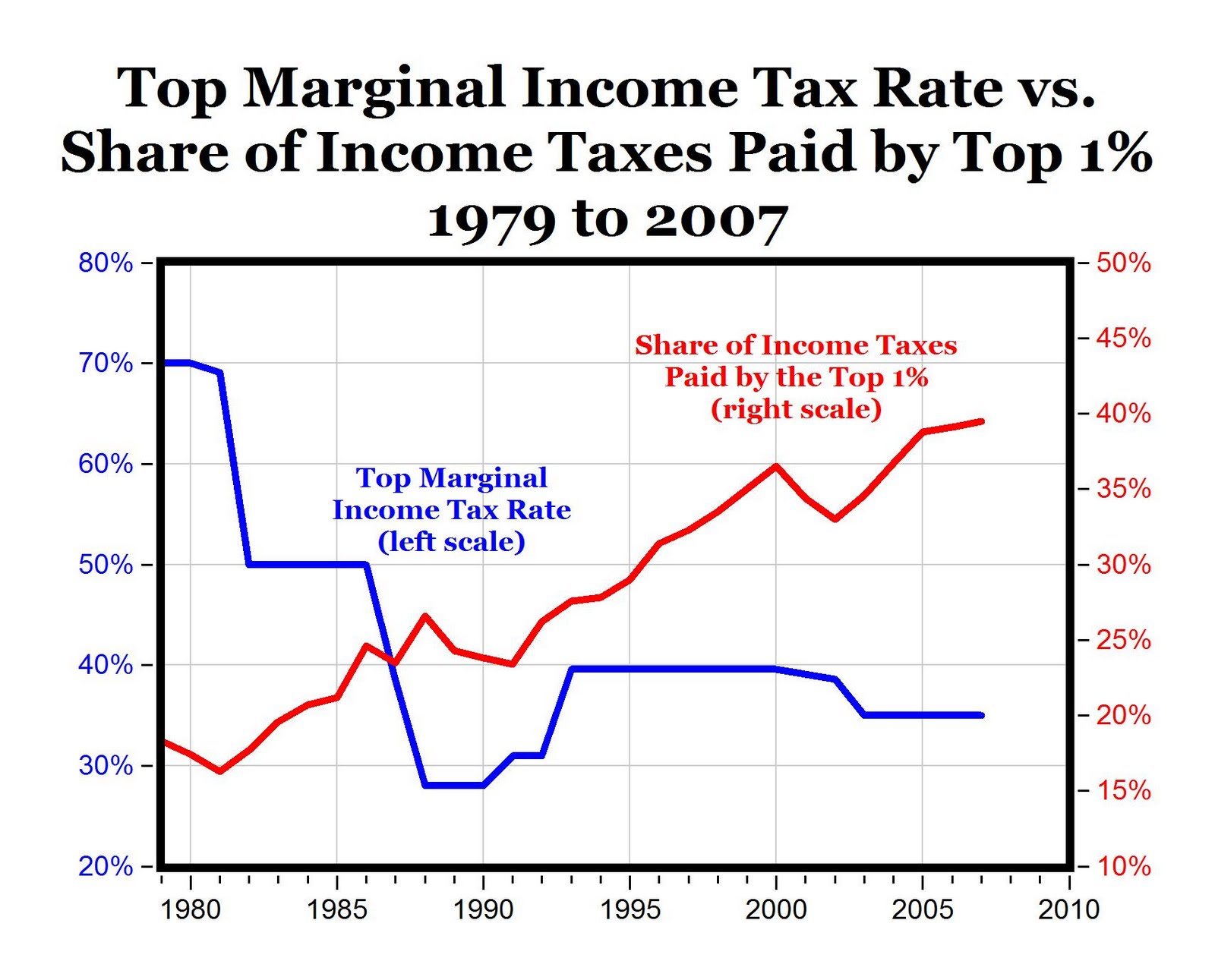

Who Pays Federal Taxes? Source, Explore sources of us tax revenue by tax type. As of january 29, the irs is accepting and processing tax returns for 2025.

Source: mungfali.com

Source: mungfali.com

Historical Chart Of Tax Rates, There are seven federal tax brackets for tax year 2025. The irs in november unveiled the federal income tax brackets for 2025, with earnings thresholds for each tier adjusting by about 5.4% higher for inflation.

Source: www.businessinsider.in

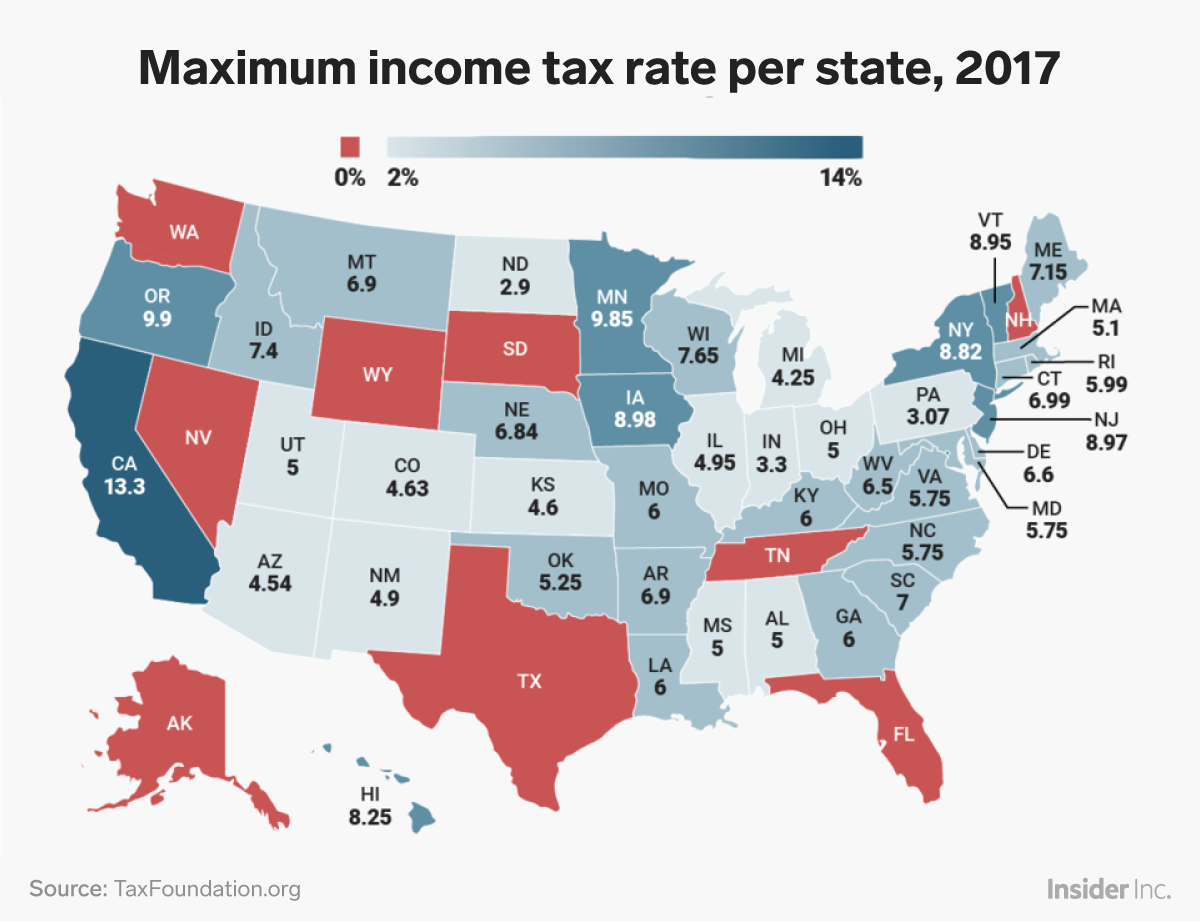

Source: www.businessinsider.in

April 17 was Tax Day in the US. This map shows the tax rate per, Most canadians will pay higher federal income taxes in 2025: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

How Federal Tax Rates Work Full Report Tax Policy Center, There are seven federal tax brackets for tax year 2025. 29, 2025, as the official start date of the nation's 2025 tax season when the agency.

Source: www.statista.com

Source: www.statista.com

Chart How Trump's Taxes Compare To Other Presidents Statista, Government budget would raise tax receipts by $4.951 trillion over 10 years, including more than $2.7. The highest earners fall into the 37% range, while those who earn the least are in the.

Source: taxfoundation.org

Source: taxfoundation.org

Where Do Your Tax Dollars Go? Tax Foundation, Every year, the irs adjusts the federal income tax brackets to account for inflation. As of january 29, the irs is accepting and processing tax returns for 2025.

Source: brewminate.com

Source: brewminate.com

Federal Budget 101 How the Process Works Brewminate A Bold Blend of, Government budget would raise tax receipts by $4.951 trillion over 10 years, including more than $2.7. Day passes, discounted tickets and monthly passes will also.

Source: www.dailyinfographic.com

Source: www.dailyinfographic.com

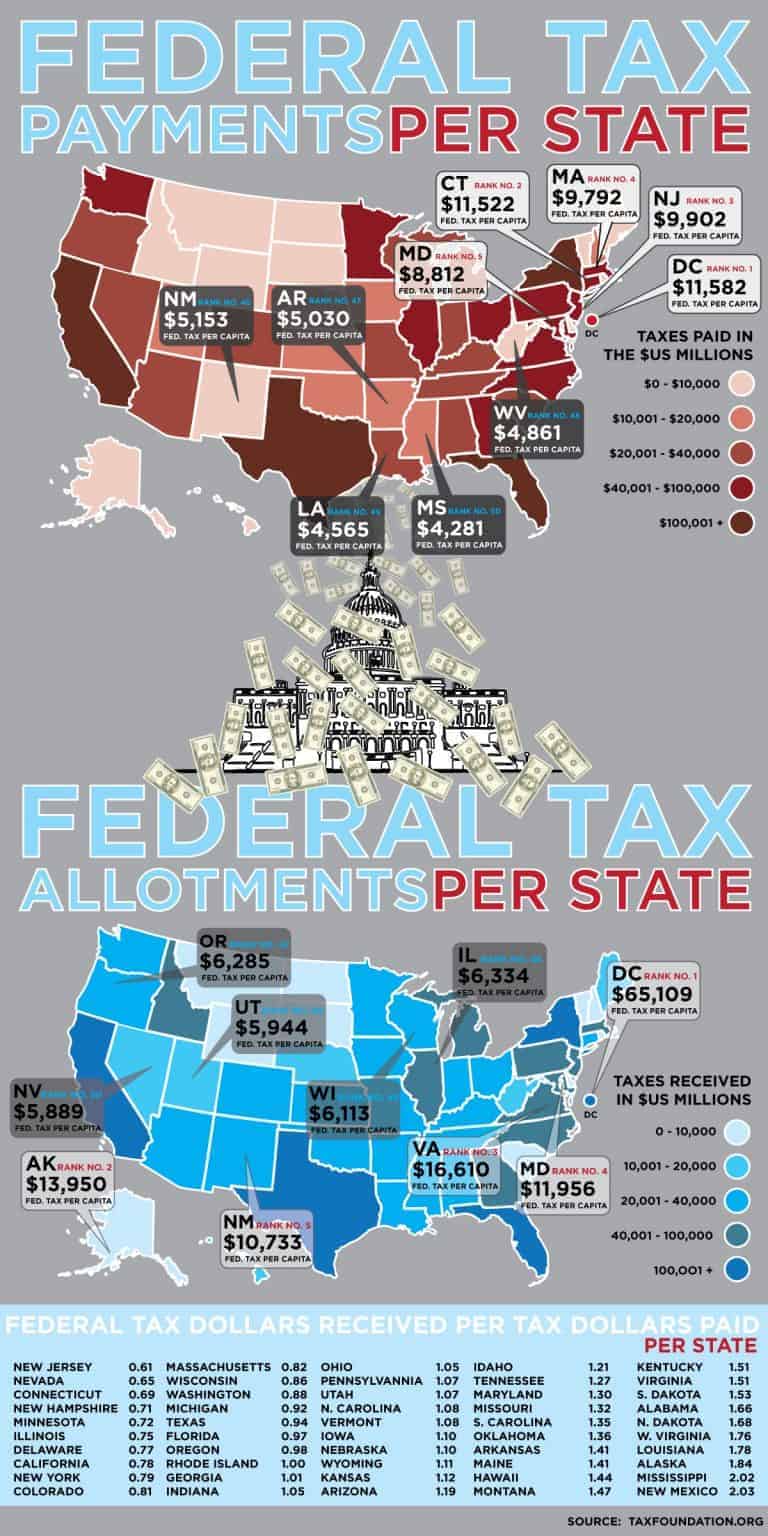

Federal Tax Dollars Per State Daily Infographic, Government budget would raise tax receipts by $4.951 trillion over 10 years, including more than $2.7. Taxable income up to $11,600.

Source: upstatetaxp.com

Source: upstatetaxp.com

Summary of the Latest Federal Tax Data, 2020 Update Upstate, Taxable income up to $11,600. The top tax rate remains 37% in 2025.

For 2025, The Tax Brackets, As Well As The Standard Deduction,.

New year, new tax measures — what to expect in 2025.

Individual Income Taxes (Federal, State, And Local) Are The Primary Source Of Us Tax Revenue.

The irs in november unveiled the federal income tax brackets for 2025, with earnings thresholds for each tier adjusting by about 5.4% higher for inflation.